Uc Copay Meaning

Serving Maryland, the District of Columbia and portions of Virginia, CareFirst BlueCross BlueShield is the shared business name of CareFirst of Maryland, Inc. And Group Hospitalization and Medical Services, Inc. CareFirst BlueCross BlueShield Medicare Advantage is the business name of CareFirst Advantage, Inc. CareFirst BlueCross BlueShield Community Health Plan District of Columbia is the.

- Copay: The part of the bill that must be paid by the patient. It is usually a fixed dollar amount. The copay is typically paid at the same time you have the service. Date of Service: The date when the lab testing was performed. Deductible: The amount you pay for covered services in a.

- An insurance copay is the amount of money or percent of charges for Basic or Supplemental Health Services that a member is required to pay, as set forth by their health plan. This is often associated with an office visit or emergency room visit. For example $5, $10 or $25.

We’ve answered some of the most commonly asked questions about health insurance to help break down what things are, how they work and what you can expect from your care.

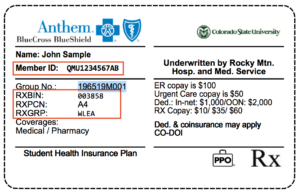

- Networks & ID Cards

- Updating Your Information

- Changing or Shopping for Plans

- Claims, Coverage & Costs

- Pharmacies & Prescriptions

A network is a group of doctors we work with to provide care to our members. Providers in our network agree to offer our members a discount. Providers who aren’t in our network don’t offer that discount, so their rates are higher.

To find your network, look at the front of your Member ID card. It’s most likely on the bottom left corner.

How do I find out if my provider’s in network or find one who is?You can search for providers by network in the Find Care tool. Either search the provider’s name and check which networks they’re in, or search for providers near you and filter your results by your network. If you log in at bcbst.com, your search results will automatically list providers in your network.

What happens when I see a provider who’s not in my network?That depends on your plan benefits. For most plans, if you see a provider who is not in your network, subject to your out-of-network deductible and coinsurance. In that case, we typically pay the amount that we’d pay a provider who is in your network, subject to your out-of-network deductible and coinsurance. You’ll pay whatever is left on your bill. Please keep in mind that some plans, like those you may have purchased through Healthcare.gov or signed up for through TennCare, don’t pay for providers who aren’t in your network.

What if I need care when I’m traveling?This depends on what kind of plan you have.

Many employer plans include the Blue Cross Blue Shield Global Core® travel program that lets you see providers in other BlueCross networks while you’re traveling. If you see a small suitcase icon on your member ID card, then you have Global Core. If you’re planning a trip and have specific questions, the best thing to do is call Global Core directly at 1-800-810-25831-800-810-2583. They’re ready to help you out.

If you have an individual or family plan, or one through your employer, you can log in to bcbst.com and enter your location into the Find Care tool.

Medicare members should contact us, and we’ll help you decide how to get care.

Uc Copay Meaning Medical

Medicaid or Medicare with Medicaid members can only get coverage for providers out of the state of Tennessee if it’s a true emergency.

How do I get a new Member ID card?You can order a new Member ID card by logging in to bcbst.com or by calling or chatting with us.

You can also download a digital version or print your own copy of your card from the same page or you can see it in the myBlueTN℠ mobile app, which you can download here.

How do I change incorrect info on my Member ID card?Click here to contact us, and we’ll walk you through getting your card updated.

How do I update personal info like my address, last name or payment information?Click here to contact us, and we’ll get your account updated.

How do I add or remove a dependent?Click here to contact us, and we’ll get your account updated.

If you want to see a different doctor than the one you were assigned, you can contact us for help, or you can do it yourself here.

How/when can I enroll in or switch an Individual or Family plan?You’ll need to enroll during the Open Enrollment Period from Nov. 1 – Dec. 15 of each year. If you’ve had a major life change (like getting married, losing your coverage, moving out of state, etc.), you could shop now with a special enrollment window for a limited time. There’s more about that here.

How/when can I enroll in or switch my Employer's plan?Your employer likely has an enrollment window each year for you to sign up, unless you’re a new employee. Talk with your HR team about how to get enrolled.

How/when can I enroll in or switch a Medicare plan?You’ll need to shop during the Annual Enrollment Period, from Oct. 15 – Dec. 7 each year to switch plans. If you’re just turning 65 or retiring, you have a window of three months before and three months after your birthday to sign up for Medicare. Some big life events – like getting married or moving – might allow you to enroll in a plan outside this window. If you have one coming up, contact us or your broker.

How/when can I enroll in or switch a Medicare with Medicaid (BlueCare Plus℠) plan?If you qualify for both Medicare and Medicaid, you may sign up for a BlueCare Plus℠ plan throughout the year. Contact us or your broker to get help.

We want you to feel confident in making your Medicare decisions. Here’s a link to get you caught up on the basics or you can give our sales team a call at 1-800-292-51461-800-292-5146.

You can also visit our Medicare website for more information.

You can check your coverage by logging in here. This will give you all the details on who and what your plan covers. Or click here to contact us, and we'll look it up and help you with the next steps if we don't cover a service you need.

I’m confused about or disagree with a claims statement or bill. What do I do?Click here to contact us, and we’ll walk you through it. You can also watch this quick video that might help introduce you to the Claim Summary.

How do I pay my providers online?We offer free online bill pay for members with individual and employer plans. Log in to your account to view your claims. Pick the one you want to pay, then click the Pay Provider button. It will take you to InstaMed’s site, where you can make a full or partial payment.

What does “premium/copay/deductible/coinsurance” mean?Here’s a quick definition for the most common terms you’ll see in insurance:

Premium: The monthly payment for your insurance policy.

Copayment (Copay): A fixed dollar amount you must pay with your own money for medical services, like office visits or prescription drugs.

Deductible: The amount you pay each year before your health plan begins paying.

Coinsurance: The percentage of costs for care that you'll pay - usually after you've paid your deductible.

Why did my costs change this year?Your health care costs can change for a number of reasons. The cost of care rising, the amount of people sharing the costs changing or a manufacturer raising or lowering their price on a drug are a few examples. If you’d like to discuss a specific change, click here to contact us, and we’ll try to answer your questions.

How do I pay my premium or change my payment information?This depends on your plan. For most plans, you can do a bank draft, check by phone, or mail in payment. Contact us and we’ll talk you through it or you can download the form here.

How do I get one of my drugs covered?

How do I get one of my drugs covered? First, talk with your doctor about any generic versions or other drugs on your drug list that might work just as well. If we don’t cover a drug you need, your doctor can send us a request to cover it if they feel it’s important to your treatment. We’ll consider the request and get back to you on our decision.

How do I find a pharmacy in my network?You can search for pharmacies by network in the Find Care tool. Either search by the pharmacy’s name or search for ones near you and filter your results by your network. If you log in to bcbst.com first, your search results will automatically list pharmacies in your network. Need more help? Click here to contact us.

What do the drug 'tiers' mean?When a new drug becomes available, they’re put into one of three categories, or “tiers.”

Tier One: Generic drugs. These drugs are made with the same active ingredients and in the same dosage as the brand-name product, but cost less. They meet the same FDA standards as brand drugs and work just as well.

Tier Two: Preferred brand name drugs. These are the most affordable brand-name drugs.

Tier Three: Non-Preferred drugs. These are more expensive brand-name drugs. Often there are other similar ones available at a lower cost in one of the other two categories.

What are “preferred” drugs or pharmacies?Our doctors and pharmacists create a list of preferred drugs to put in our formulary (your list of covered drugs). Our drug list includes preferred generic (Tier 1) and preferred brand name (Tier 2) drugs. Non-preferred brand name (Tier 3) drugs are not part of the preferred drug list, but are covered by your pharmacy benefits, just at a higher cost.

Some plans have a list of “Preferred Pharmacies” that have agreed to keep costs even lower for our members and you’ll save money if you use them instead of a standard one in your network.

What is a specialty pharmacy or drug?A specialty drug is a prescription drug that is given by injection or infusion, sometimes by you and sometimes in the doctor’s office. You’ll often get the best price for your medicine by getting it from certain specialty pharmacies, even if it’s your doctor or preferred facility doing the procedure. Learn more.

Do we accept cash payments?

We accept cash payment. Your cost is based on a formula which we will review with you at the time of service. Our contracted insurance rates are a significant savings from emergency rooms and our cash pay rates offer similar savings. Please call us and we can discuss your specific questions.

What is a deductible?

A deductible is the amount of money you must pay towards your medical expenses before your insurance kicks in. This means you are responsible for your complete bill until you have paid as much as your deductible. For example, if your deductible is $2000 you will be responsible for this much money out of pocket before your insurance starts to cover your bills.

What is coinsurance?

Coinsurance is your share of your medical bills which usually does not kick in until after your deductible is met. Once you have met your deductible you may be required to pay coinsurance which is often a percentage of each bill. This is tricky because every insurance plan is different and within each plan you may be responsible for a different coinsurance percentage depending on the type of service.

What is a co-pay?

A co-pay is a set amount you pay at the time of a particular service usually when that service is received. The amount varies depending on your insurance and the type of service you are receiving. Typically and urgent care copay is much lower than an ER copay and your pharmacy benefit will often have tiered levels of medication copays.

Will I have more than one bill?

We strive to keep our bills simple. You will receive one bill from us unless you have a radiology study completed and then you will receive a bill for the radiologist read. Our board-certified radiologists are in-network and are worth every penny of their expert read.

Are our physicians in network?

What is the difference between in-network and out-of-network?

There are many different kinds of healthcare plans administered by many companies making it difficult to provide detailed information, but we are always happy to answer questions by phone.

Uc On Insurance Card

In general, if you visit an in-network provider your costs may be lower. This is because a contract implies that your insurance company and physician have contracted rates that are lower than out-of-network costs. Meaning, if you have a coinsurance percentage that you pay, a lower bill means your percentage will be lower. In some plans going out of network means that you are responsible for the entire bill and in others you may be responsible for a portion of the bill. Our goal is to develop contracts with every major insurance plan. Please call us to determine of your insurance company has contracted with us yet.

How do we determine your payment?

If your insurance company has contracted with us, we work on a tiered system comparable to how an emergency department bills: level 1-5. Level 1 is the most basic care and level 5 is the sickest of patients with life-threatening emergencies often requiring intervention and admission to the hospital. Levels 2-4 gradually increase in severity each requiring a higher payment. Our level one and two costs are similar to urgent care fees. Our level three through five acuity is similar to ER patients and these costs are typically less than 30% of ER costs for similar care.

We’re continually adding new insurers. For specific insurers we work with now, please call us at (719) 522-2727.

CALL WITH CHEST PAIN QUESTIONS

(719) 522-2727

Our staff is ready for you Sunday-Thursday from 11:00 A.M. – 10:00 P.M. and Friday and Saturday 11:00 A.M.- 11:00 P.M.

Uc At Your Service

- Urinary Tract Infection and Kidney Infection-What is a Urinary Tract Infection? The term UTI (Urinary Tract Infection) is commonly used to indicate an infection in the bladder. Pyelonephritis is an infection of the kidney. What are my chances of having a UTI? Unfortunately 50% of women will suffer a urinary tract infection in their lifetime… Read More

- What is Appendicitis?-Appendicitis The appendix is a small tubular structure that is skinny and about 4 inches long. If you picture an earthworm you get the idea. It is located in the right lower region of your abdomen where the small bowel and large bowel join. It is unclear what the appendix… Read More